Featured

Featured

Amy is now open to all firms

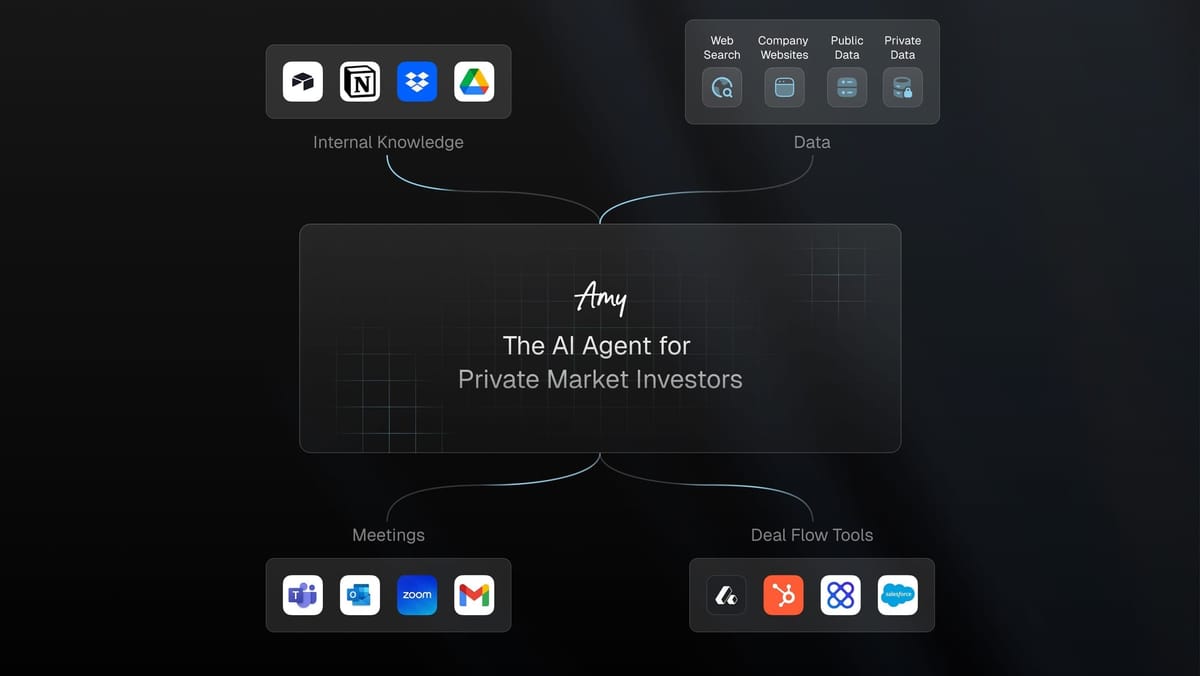

Amy is the AI agent for private market investment teams, and is now open to all firms.

Hand-picked stories worth your time

Featured

Featured

Amy is the AI agent for private market investment teams, and is now open to all firms.

Featured

Featured

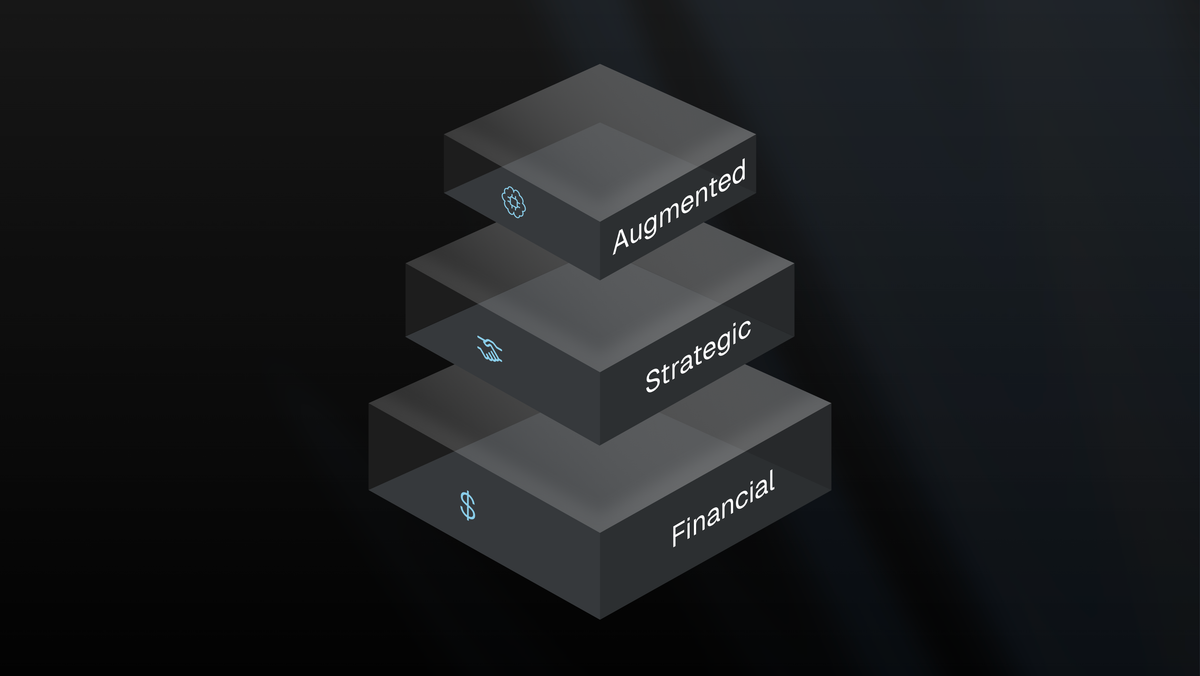

Traditional Investor Paradigm: Financial vs Strategic Capital In private markets, traditionally there have been two paradigms of investors: financial and strategic. A financial investor provides capital in exchange for returns on their investment, the traditional buy-low, sell-high strategy or the buy-and-hold strategy. The goal for financial investors is to focus

Featured

Featured

2 weeks ago, we announced Amy to the world, the first AI Agent for private market investment teams. Over 800 investment firms joined the waitlist, ranging from early-stage venture firms to endowment funds managing $100b+. We've hand-picked a selection of these firms to join our closed beta, where

Featured

Featured

Amy is the AI agent for private market investment teams, and is now open to all firms.

Executive Summary * Company Name: Clove * Description: Clove is a pre-launch fintech company building a financial institution that combines human expertise with AI to make financial advice more accessible and affordable. * Key Metrics: * Pre-seed funding of $14 million. * Team of six, with plans to expand. * Pre-launch, with a full launch planned

Executive Summary * Company Name: FleetWorks * Description: Fleetworks.ai provides an AI-powered "always-on dispatcher" for the trucking industry, automating load booking, carrier communication, and freight matching to save time and increase efficiency for both carriers and brokers. * Key Business Metrics: * 18 employees (up 125% YoY) * $17M in total funding

Flow Engineering has raised a $23 M Series A round led by Sequoia Capital, bringing its total funding to $34 M. The company delivers a modern requirements‐management platform for hardware engineering teams, already working with Rivian, Joby Aviation, Astranis and Radiant.

Quilter.ai has secured a $25 M Series B round led by Index Ventures, following its Feb 2024 $10 M Series A. The company offers a physics-driven AI platform to automate PCB layout—cutting design cycles from weeks to minutes and targeting aerospace, defense and consumer electronics.

Zingage, an AI-powered home healthcare platform, raised $12.5M in seed funding to automate scheduling, staffing, and compliance, helping over 400 agencies reduce admin work and improve care delivery.

With Amy, private market teams can focus less on reading and more on exploring and deciding. Turning every document into an opportunity for sharper, faster, and smarter investment action.

FurtherAI, an AI workspace for insurers, raised $25M Series A to automate underwriting, claims, and submissions, boosting speed and efficiency.

Nia, a YC-backed startup, raised $6.2M to solve AI coding agents’ “context bottleneck.” Its MCP-based platform indexes code and docs to enhance AI accuracy and developer productivity, backed by CRV, BoxGroup, LocalGlobe, and top angels like Paul Graham and Thomas Wolf.

Vercel, creator of Next.js, raised $300M (Series F, $9.3B valuation) to expand its AI Cloud and developer platform. With $200M ARR and rapid AI tool adoption, Vercel leads the next wave of web performance and intelligent app deployment.

Composite Sciences, backed by Menlo Ventures, Nat Friedman & Daniel Gross, raised $5.6M to expand its AI-powered browser automation platform that boosts productivity, automates workflows, and builds enterprise-ready solutions.

Mistral AI is emerging as one of Europe’s most compelling investment opportunities in the generative AI space. Backed by top-tier investors including DST Global, Andreessen Horowitz, and NVIDIA, the company recently secured a €1.7B Series C round, signaling strong private market confidence.