In the fast-paced world of private markets, clarity and speed aren’t just nice to have; they define a competitive advantage. Every day, investors sift through a sea of information from pitch decks, reports, and financial models, seeking to extract the insights that truly matter. Hours are lost in the process of reading, comparing, and cross-referencing, which is time that could be spent making decisions.

That’s where Amy, the AI Agent for private market investors, changes the game.

From Upload to Instant Understanding

Imagine passing a pitch deck, financial model, or LP report to Amy and, within seconds, getting a precise summary of what matters most to your investment firm. Amy doesn’t just read, she understands. She highlights red flags, extracts key metrics, and provides insights. What once took an afternoon now takes moments.

Converse with your colleague, don’t just command her

Have a dynamic conversation with Amy, like you would with a colleague. Instead of jumping between spreadsheets and notes, you can simply ask:

“How does this company’s revenue growth compare to the last deal we reviewed?”

“Are there any inconsistencies in their financial projections?”

“Does this term sheet align with our standard conditions?”

"Perform a web search on MRNA Therapeutics Market and add it to the report."

Amy answers instantly, explaining, verifying, and refining analysis with every question. You’re not just chatting with files; you’re collaborating with a teammate.

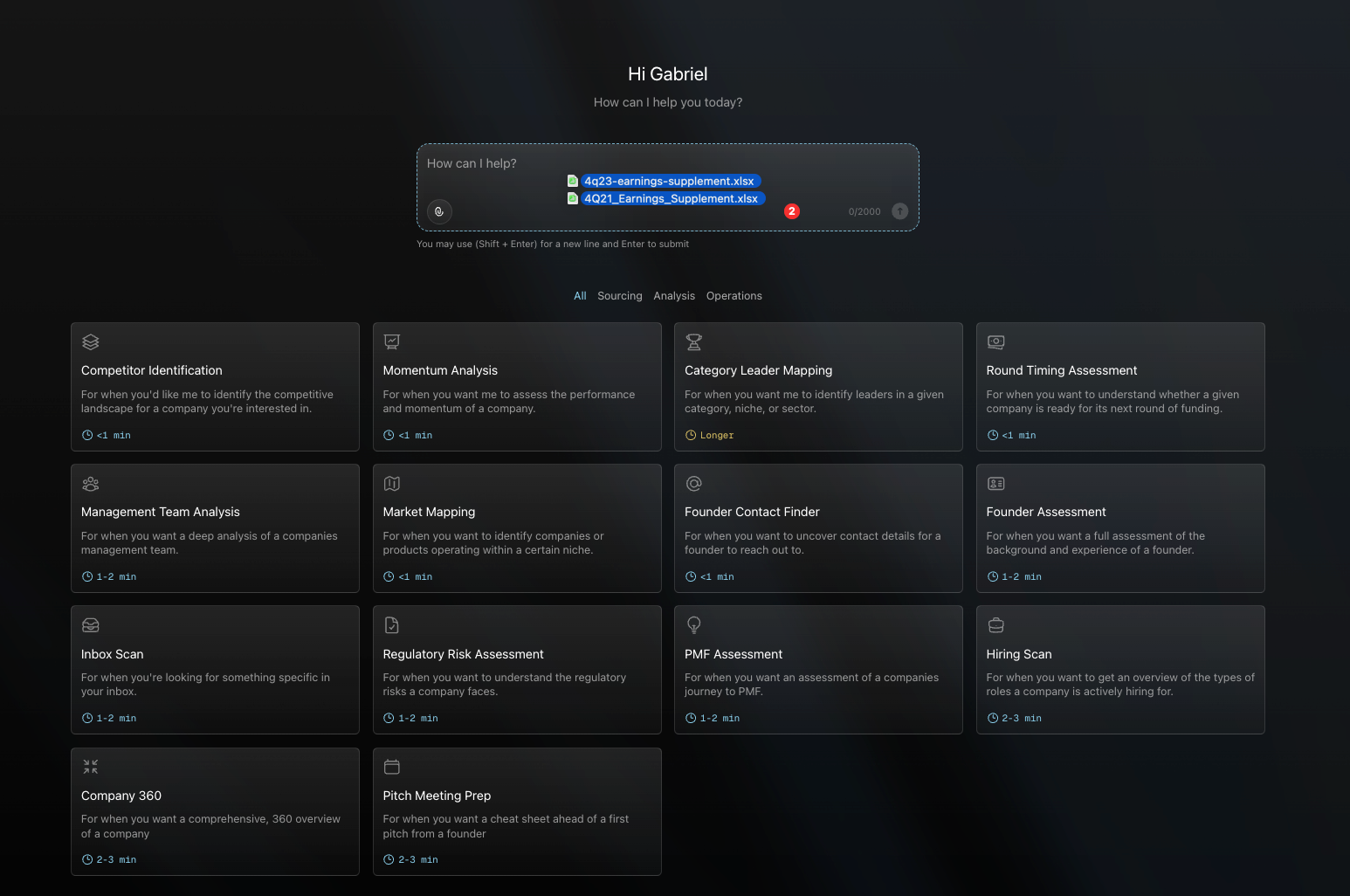

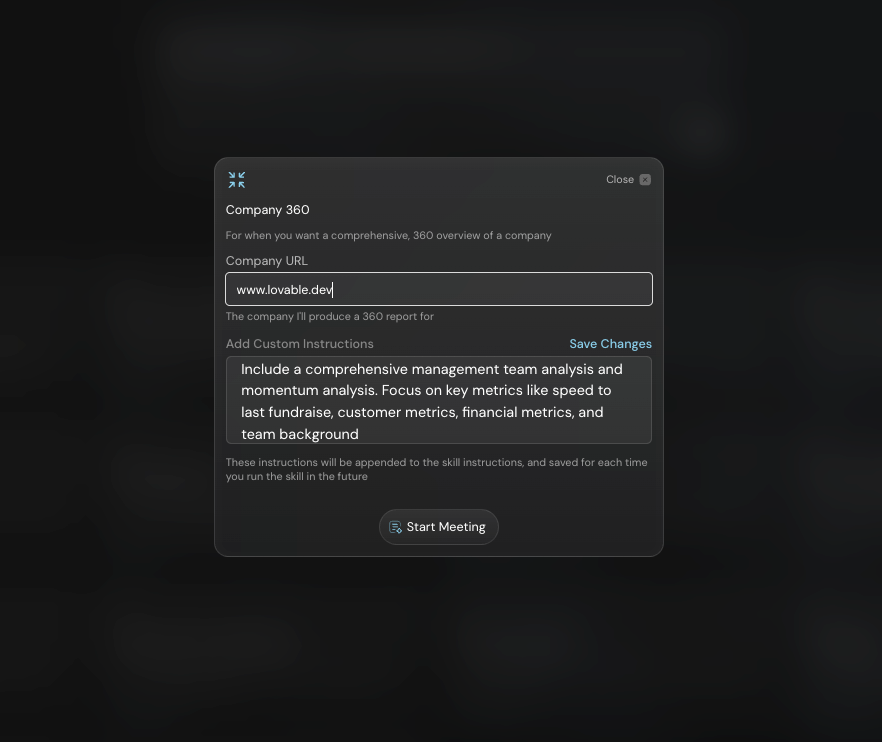

Tailored to Your Firm’s Way of Working

Every firm has its own investment philosophy. With Amy’s customizable skills, teams can fine-tune how she analyzes her reports. Whether you want her to focus on specific valuation methods, highlight key metrics, or follow your firm’s due diligence checklist, Amy learns from your preferences and applies them consistently, across every deal.

Supercharging Private Market Workflows

By automating the manual, repetitive parts of investment work such as extracting data, cross-referencing documents, or verifying claims, Amy helps investment teams move faster from data to decision.

She enables:

- Faster deal review: Go from pitch deck to IC-ready summary in seconds.

- Smarter analysis: Spot trends and risks automatically.

- Reduced friction: Work seamlessly in one place. No context switching.

- Firm-wide consistency: Keep everyone aligned with customizable skill sets.

What It Means for Investors

Amy transforms investment operations:

- Pitch Deck Analysis: Evaluate companies and surface red flags instantly.

- Company Reporting: Summarize LP or portfolio updates effortlessly.

- Investment Memo Writing: Generate tailored IC-ready memos on demand.

- Legal & Financial Review: Highlight key risks and anomalies before they matter.

- Due Diligence: Cross-check documents against your checklist automatically.

In Essence

Amy doesn’t just analyse, she accelerates insight. She’s not another tool to learn, she’s a teammate who learns from you.

With Amy, private market teams can focus less on reading and more on exploring and deciding. Turning every document into an opportunity for sharper, faster, and smarter investment action.

Ready to welcome Amy to your team? Share a few details in this short survey to move to the front of the line.