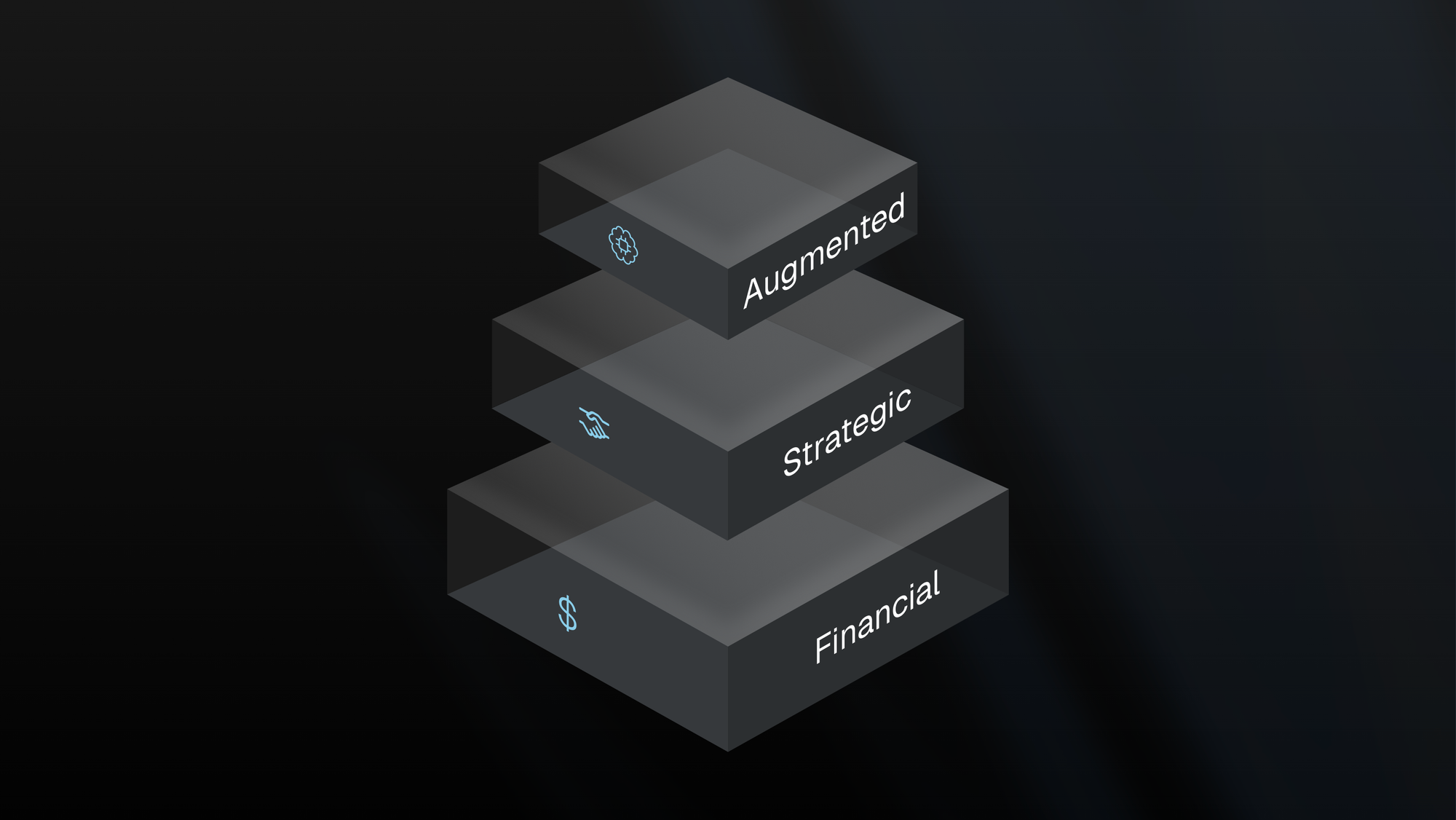

Traditional Investor Paradigm: Financial vs Strategic Capital

In private markets, traditionally there have been two paradigms of investors: financial and strategic. A financial investor provides capital in exchange for returns on their investment, the traditional buy-low, sell-high strategy or the buy-and-hold strategy. The goal for financial investors is to focus on key metrics with a clear exit strategy (IPOs or acquisitions) and minimal involvement. This was an effective strategy when capital was limited to private companies with far fewer private investors, back when getting into a competitive round didn't require a sharpened edge.

To put it into perspective, the number of firms and dry powder that's available for private equity investments exploded over the last 20 years.

This trend can also be shown with the number of private companies increasing relative to public companies. Companies can afford to remain private longer with adequate capital requirements being met in the private markets. Historically, public markets were used to provide those capital requirements.

In the current environment, where capital is abundant and competition is fierce, a majority of private equity firms have evolved from financial investors to strategic investors. The saying “not all money is equal” is especially true in the private markets and is used to differentiate in a highly competitive market. Today, capital alone can get you ghosted in competitive rounds. While financial investors wrote the first checks, strategic investors rewrote the playbook by adding brains, backing, and a serious value-add to the game. Their investment is driven by providing strategic benefits to generate returns for their investments. This can take shape in the form of industry expertise, mentorship, industry connections, and operational support to help companies beyond capital. The top companies are picking partners who offer an unfair advantage, not just a check.

But with the emergence of new technologies, this has set the stage for an emerging approach, which we call “Augmented Capital.”

Augmented Capital Approach

The third wave of private markets is creating augmented investors, not only strategic (“value add”) but also intelligent in how the capital is deployed. Augmented capital means leveraging data, technology and AI to make “smarter” decisions in delivering value to generate returns from their investments. It builds on the idea of how investors differentiate themselves in the future by leveraging technological innovations, the "GPT moment" for private investing. Everyone saw AI coming, but only a few are capitalising on it. Augmented investors are the early adopters. They provide capital, they offer domain expertise, mentorship and access to networks, and now they add a new layer of intelligence to further drive value creation.

What's changed?

Private markets were once data-lite, but with the explosion of the digital economy, amplified by COVID era, both companies and individuals now produce an enormous digital footprint. Ironically, more data has made decision making harder, sifting through the noise and the signals. More data should mean better decisions, but only for those who are equipped to handle the volume.

Combined with highly competitive deal turnarounds and the pressure to make the right decisions, it’s become extremely challenging. There’s more information than ever to parse, but also less time to act. Hot deals require an immediate turnaround, and you’re only as good as your last deal. If you're still relying on Monday investment committee meetings to make a decision, you're too slow. To gain an edge on speed without compromising diligence, augmented investors are turning to technology. What was previously a service based industry is now turning into a technology enabled service based industry. Using AI tools like Amy to inform and accelerate decision making has become a source of alpha.

Augmented capital means investors can move with greater speed, confidence and precision. The future of wealth is not just financial, it’s intelligent. The next generation of investors will differentiate themselves by how smartly they deploy their capital, not just how much they deploy.

Notably, embracing augmented capital doesn’t mean replacing human investors with algorithms or AI. It’s about augmenting human expertise with AI. Private markets will still be a people based business where AI won’t have access to certain information. The best firms will be a blend of machine precision with human context to analyze patterns in huge data sets, model outcomes, and automate workflows. It’s an evolution from providing financial capital to strategic capital to augmented capital.

Use Cases of how AI Agents are Powering Private Market Investments

Smarter deal sourcing & faster deal velocity

Perhaps the most immediate impact is on sourcing deals and moving them quickly through to an investment decision. AI can scan vast datasets (news, databases, social media) to identify emerging trends and targets earlier than a human could. Teams can automate data gathering and communications to expedite decisions and close deals faster. Speed matters when competition is high, and AI gives investors the ability to accelerate good investments rather than losing them due to slow processes.

Enhanced due diligence and decision quality:

The process of due diligence is slow. AI is transforming this process by digesting and summarizing documents, analyzing financial statements or highlighting red flags in minutes, not hours. Every hour saved in manual work required for diligence is a chance to chase the next big opportunity or beat someone else to it.

Value add for portfolio companies

Augmented capital continues post investment. AI has the opportunity to support portfolio companies in a meaningful way. Investors can act as an extension of the teams and at scale. Investors are delivering “AI advisors” alongside their capital, which is a huge strategic asset for companies. It’s a win-win model with companies leveraging the firm’s AI expertise to help grow faster and smarter while the investors increase the value of their investments. Many firms are also deploying AI for operational support, like automating reporting and monitoring.

Internal efficiency and knowledge leverage:

Lastly, an overlooked aspect is how AI makes the investment firm itself more efficient with workflow automations but also with collective intelligence. Private market firms deal with countless documents, emails and analysis across multiple deals. AI powered internal knowledge base means a firm can instantly search and retrieve institutional knowledge that has been siloed, in order to provide collective intelligence for the wider team. Every private market firm’s intellectual property is knowledge, and this is a huge unlock for the firm. AI turns tribal knowledge into a competitive advantage. The next investment opportunity might be buried in your tech stack.

In short, AI Agents are helping investment teams do more with less, which is crucial in an environment where speed, accuracy, and lean operations can outcompete slower moving players.

Conclusion: toward a new standard in investing

Taken together, these innovations mean that augmented capital investors can execute deals with greater velocity and insight than ever before. They combine the art of investing (judgment, experience, relationships) with the science of investing (data, analytics, predictive modeling). The firms embracing these technologies are setting a new performance standard in private markets, while those who stick to the old ways risk falling significantly behind.

Just as strategic investors once set themselves apart by offering value added services from financial investors, today’s augmented capital investors go a step further by offering intelligence as a service.

For private market professionals, the message is clear: adapt and augment, or risk getting left behind. Embracing augmented capital means rethinking team composition, investing in the right systems, and training your people to leverage AI in their day-to-day work. It means freeing your team from spreadsheet drudgery so they can spend more time building investment thesis, problem solving, strategical thinking, and forging connections, the things that humans excel at and AI cannot replace…yet.

In the end, augmented capital is about empowerment, for investors and the companies they back. Companies get quicker access to funding and actionable intelligence from their investors; investors get to make wiser bets and amplify their impact. The private markets have always been about finding that next great company before others do. With augmented capital, the rules of that game are changing. As we look ahead, the most successful investors will likely be those seen not just as sources of capital, but as partners in intelligence.